Can a Federal Reserve Interest Rate Cut Boost Bitcoin’s Surge?

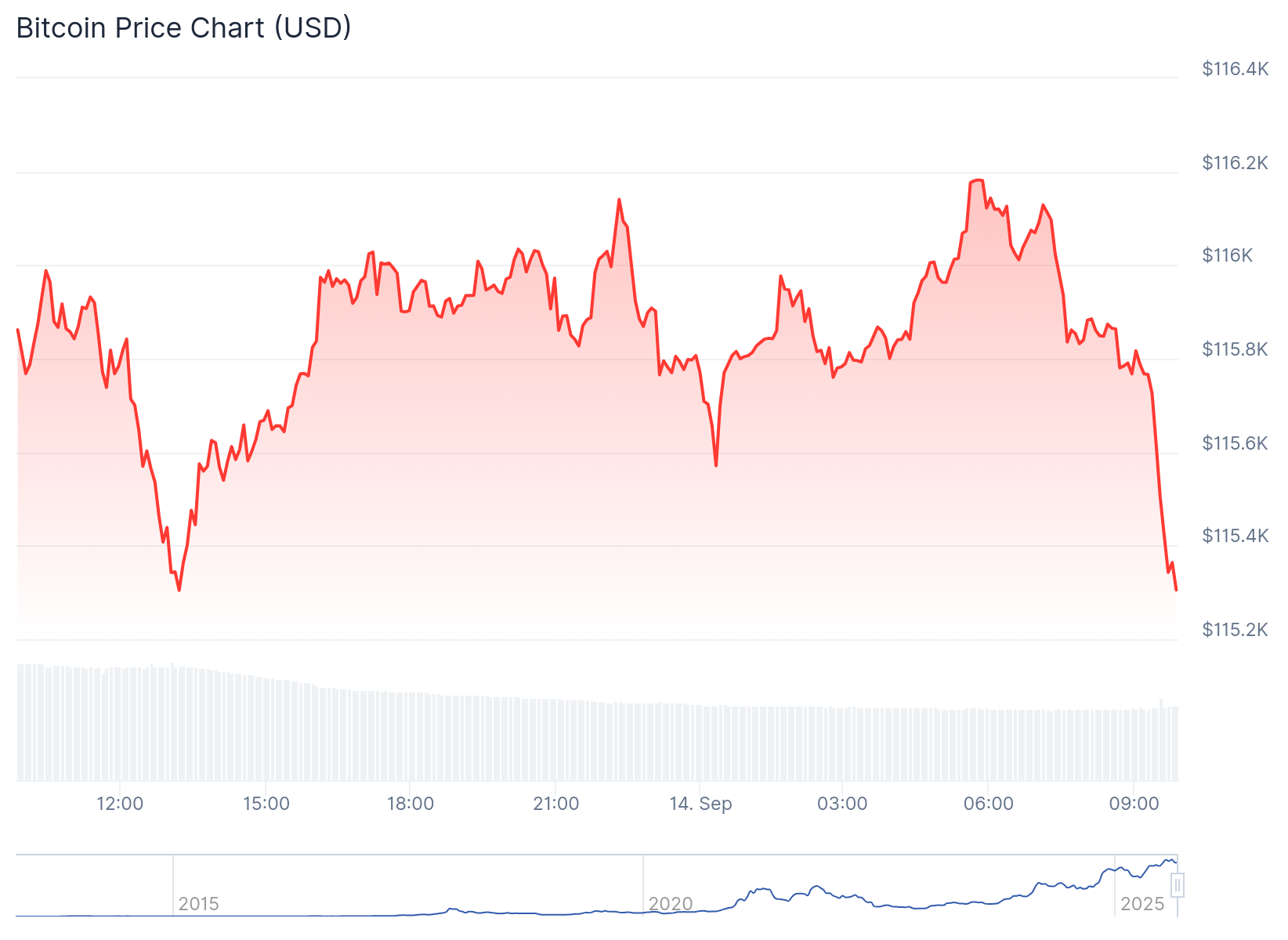

Recently, Bitcoin passed the $115,000 mark, fueled by growing expectations of Federal Reserve interest rate reductions and over $2.3 billion in inflows from exchange-traded funds.

As of the latest update on Sunday, Sept. 14, the top cryptocurrency saw a 0.5% drop for the day. More details are provided below.

Summary

- Bitcoin’s price has risen in anticipation of the Federal Reserve’s upcoming interest rate decision.

- Analysts are forecasting a 0.25% cut from the central bank.

- While a price increase is anticipated, a rising wedge pattern suggests a possible reversal.

Predicted Federal Reserve Interest Rate Cuts

This week, the pivotal macro factor will be the Federal Open Market Committee (FOMC) interest rate announcement due on Wednesday.

As per Kalshi and Polymarket, the chances of a 25 basis point cut are nearly certain. This expectation is further supported by the CME FedWatch Tool.

Typically, the initiation of interest rate cuts by the Federal Reserve is regarded as beneficial for Bitcoin (BTC) and the wider cryptocurrency market. Historically, these assets tend to thrive in environments with easy monetary policies but struggle when the Fed tightens its stance.

For example, Bitcoin hit an all-time high during the pandemic as the Fed lowered rates, then plummeted below $16,000 when rates were increased in 2022.

The timing of the rate cut also supports a bullish outlook, coinciding with the fourth quarter, traditionally the strongest quarter. Data from CoinGlass reveals that Bitcoin has yielded an average return of over 84% in Q4 since 2013.

However, there is a concern that the Fed’s decision may not favor Bitcoin due to two primary reasons. First, the rate cut could already be reflected in the market, increasing the likelihood of a sell-the-news event. This risk intensifies if the Fed takes a hawkish tone in their announcement.

Risky Patterns in Bitcoin’s Price Movements

Another major concern is the emergence of a nearly-perfect rising wedge on Bitcoin’s weekly chart, which features two ascending and converging trendlines. This convergence signals a heightened likelihood of an impending breakdown.

Furthermore, technical indicators like the Relative Strength Index and MACD are revealing a bearish divergence. This suggests that while the asset’s price is increasing, the underlying momentum is waning.

Consequently, despite the favorable implications of the Fed’s rate cut for Bitcoin and the cryptocurrency sector, there is an ongoing risk of a correction during this period.