Oil Prices Fluctuate amid Trader Speculation over Trump’s Russian Sanctions Warning

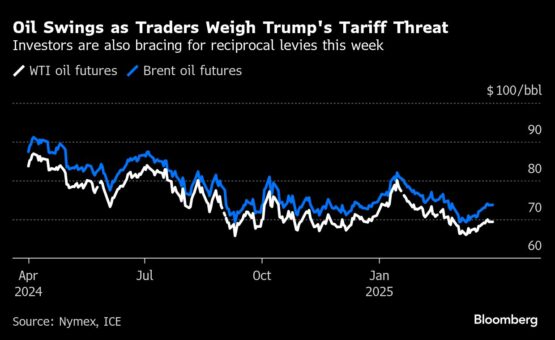

Oil prices experienced fluctuations as the market assessed Donald Trump’s mixed comments regarding the possibility of new sanctions on Russian crude if Vladimir Putin does not agree to a ceasefire with Ukraine.

On Air Force One, Trump expressed his belief that Putin would not “go back on his word,” a statement that seemed to soften his earlier criticism on Sunday when NBC News reported him as being “very angry” at the Russian president and mentioning the possibility of “secondary tariffs.”

ADVERTISEMENT

CONTINUE READING BELOW

Brent’s June contract remained relatively stable just below $73 per barrel after a slight gain at the start of trading, while West Texas Intermediate hovered around $69. Trump’s warning comes just before the implementation of reciprocal US tariffs this week on other countries, which could trigger additional retaliatory actions and heightened market volatility.

As one of the globe’s largest oil producers, Russia’s potential punishment could significantly impact the overall crude market. Key buyers, India and China, which have stepped in since Moscow’s invasion of Ukraine, would feel particular pressure.

“Whether these tariffs are just tough rhetoric or if they will actually be enacted remains uncertain,” said Gao Jian, an analyst at Qisheng Futures Co. “However, given the scale of Russia’s oil trade, he needs to carefully evaluate the risks and benefits.”

In March, exports of crude from the OPEC+ producer reached a five-month peak, with indications showing that US sanctions on the nation’s oil tanker fleet are beginning to weaken. Trump stated in a phone interview with NBC that he would impose penalties if a resolution on Ukraine is not reached “and if I think it was Russia’s fault.”

Additionally, Trump mentioned he is contemplating imposing unspecified “secondary tariffs” on Tehran and hinted at the potential of military action against Iran until they agree to a deal renouncing their nuclear weapons program.

ADVERTISEMENT:

CONTINUE READING BELOW

Brent futures are expected to show a slight monthly increase as concerns over new US tariffs and sanctions have raised apprehensions about possible disruptions in crude supplies. Despite this, major traders maintain a bearish outlook for the rest of the year because of anticipated rising supply levels. OPEC+ is set to resume production next month.

| Prices: |

|---|

|

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.