Trump Administration Works to Enhance Biden’s Limits on Chinese Semiconductor Exports

The administration of Donald Trump is outlining more stringent versions of US semiconductor restrictions and urging key allies to heighten their limitations on China’s chip industry. This move indicates that the new US president intends to broaden the initiatives that started under Joe Biden to curtail Beijing’s technological advancements.

Recently, Trump officials conferred with their Japanese and Dutch counterparts about preventing engineers from Tokyo Electron and ASML Holding NV from servicing semiconductor equipment in China, according to individuals familiar with the discussions. The objective—which was also a focus for Biden—is to ensure that major allies adopt similar restrictions to the ones the US has imposed on American chip-equipment companies like Lam Research Corp, KLA Corp, and Applied Materials.

ADVERTISEMENT

CONTINUE READING BELOW

The meetings come in addition to preliminary discussions in Washington regarding sanctions on specific Chinese companies, other sources stated. Some Trump officials are also looking to tighten restrictions on the types of Nvidia Corp chips that can be exported to China without a license, as previously reported by Bloomberg News. Furthermore, they are having early talks about imposing stricter limits on the number of AI chips that can be exported worldwide without a license, according to sources who requested anonymity as the discussions are confidential.

Shares of Japanese chip companies fell following Bloomberg News’s report, with Tokyo Electron experiencing a 4.9% decline. Nvidia’s shares were relatively stable in early trading on Tuesday.

The overarching aim in Washington is to inhibit China from further developing a domestic semiconductor industry that could enhance its AI and military capabilities. Trump seems ready to continue efforts that Biden initiated. This entails pursuing agreements with allies that did not materialize during the previous administration and adopting the priorities set by the more hawkish members of Biden’s team, who struggled to reach internal agreement on their more aggressive policy objectives.

A representative from the White House did not immediately reply to a request for comment. Both the Dutch and Japanese ministries of foreign trade and economy, trade, and industry respectively declined to comment.

Despite the US government’s attempts to prevent chips from reaching China, companies in the Asian country have discovered alternative ways to access them. A recent example reported by Bloomberg News indicated that US officials are investigating whether the Chinese AI startup DeepSeek obtained advanced Nvidia chips via third parties in Singapore, thus evading export controls.

It might take several months before these discussions yield new US regulations, especially as Trump makes personnel decisions within important federal agencies. It also remains uncertain if allies will be more amenable to the new leadership in Washington. Although the previous administration reached a handshake agreement with the Hague regarding the limitation on maintenance of equipment in China, the Dutch hesitated after Trump won the election, according to two senior Biden officials. Without regular maintenance and servicing, chip-making equipment from ASML and other suppliers can quickly lose its capability to meet the demanding standards of semiconductor production.

Biden’s team also transferred several additional priorities to officials on Trump’s national security council, as disclosed by one official, and the new team showed openness to those initiatives. A significant measure includes blocking Chinese memory chip manufacturer ChangXin Memory Technologies Inc. from acquiring American technology, a step Biden’s officials considered seriously but ultimately did not pursue due to pushback from Japan.

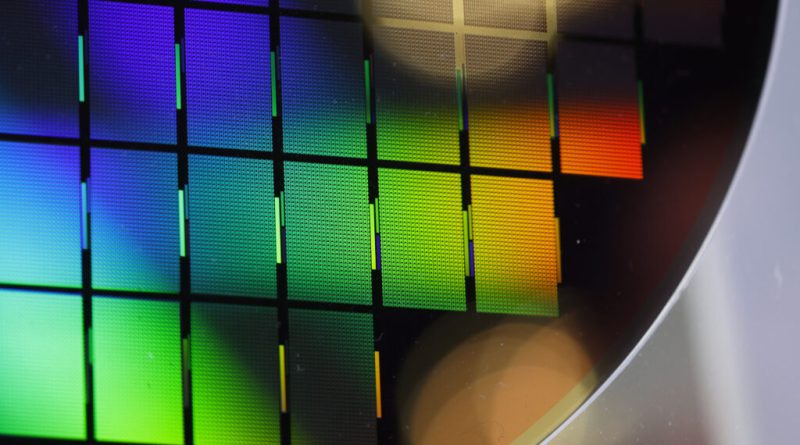

A Semiconductor Manufacturing International Corp. (SMIC) production facility in Shenzhen. Image: Qilai Shen/Bloomberg

Some members of Trump’s team are also looking to intensify restrictions on Semiconductor Manufacturing International Corp., the primary chipmaking collaborator for Chinese telecom giant Huawei Technologies. Biden effectively restricted shipments to certain SMIC facilities but instituted a case-by-case review for others, which officials worry might allow SMIC to acquire tools that are ultimately deployed at restricted plants. SMIC’s shares closed down 1.45% in Hong Kong.

ADVERTISEMENT:

CONTINUE READING BELOW

The new administration is also contemplating restrictions on the sales of chips specifically designed by Nvidia for China, according to Bloomberg’s reports. Some of Biden’s NSC officials sought to implement these tighter measures before leaving office, as several sources revealed, but then-Commerce Secretary Gina Raimondo chose not to pursue them.

Moreover, there is the so-called AI diffusion rule that was enacted during the final week of Biden’s presidency. This regulation categorized the world into three tiers of countries and set maximum thresholds for the AI computing power that can be exported to each tier. It also established mechanisms for companies to validate the security of their projects and gain access to higher compute limits.

Jensen Huang. Image: An Rong Xu/Bloomberg

This framework will impact data center growth from Southeast Asia to the Middle East and has faced strong criticism from companies like Nvidia, where CEO Jensen Huang expressed hope that the Trump administration would take a less regulatory approach.

The White House is discussing how to streamline and enhance that framework, according to several individuals familiar with the conversations, although the specifics remain uncertain.

One proposal favored by some in the administration includes reducing the computing power that can be exported without a license. Currently, chipmakers are only required to notify the government before exporting the equivalent of up to 1,700 graphic processing units to most countries. Some Trump officials are advocating for a reduction of that threshold, according to sources familiar with the discussions, which would extend the range of the licensing requirement.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.