French Institution Launches Euro Stablecoin EUROD on Bit2Me

The French banking firm ODDO BHF has announced the launch of a new euro-pegged stablecoin, named EUROD, which will be listed on the crypto platform Bit2Me in Madrid.

Summary

- ODDO BHF has introduced EUROD, its new stablecoin pegged to the euro, marking its entry into the cryptocurrency sector.

- This initiative is part of a larger trend among European banks to develop euro-pegged stablecoins to compete with the rising popularity of U.S. dollar-based currencies.

According to a recent report from CoinDesk, the major French bank has launched its stablecoin, EUROC, which will be available on the Madrid-based crypto exchange Bit2Me. Designed as a low-volatility digital euro, EUROD complies with the EU’s MiCA regulatory framework.

With a 1:1 backing, EUROD targets both retail and institutional users.

This initiative represents a significant step forward for the traditional financial institution, which manages assets over €150 billion (approximately $173 billion) across Europe. ODDO BHF aims to provide a trustworthy and regulated digital asset for investors seeking stability amidst the volatile crypto landscape.

“The launch of ODDO BHF’s euro stablecoin marks a key milestone in Bit2Me’s mission to offer reliable, regulated digital assets,” said Bit2Me CEO Leif Ferreira in a press release to CoinDesk.

Earlier this year, Bit2Me raised €30 million (around $35 million) in an investment round led by Tether, the stablecoin issuer. By listing ODDO BHF’s EUROD, Bit2Me seeks to bridge the traditional finance and crypto sectors.

ODDO BHF’s first venture into cryptocurrency

The unveiling of the euro-backed stablecoin signifies ODDO BHF’s inaugural entry into the crypto space. The bank joins other European financial institutions that are adopting the stablecoin trend. Earlier this month, Societe Generale’s digital asset division launched its U.S. dollar-backed and euro-pegged stablecoins via Morpho and Uniswap.

As previously reported by crypto.news, SG-FORGE aims to market its stablecoins as effective options rather than substitutes for fiat currencies, viewing them as regulated instruments for specific uses.

A collaborative effort among nine European banks, including UniCredit SpA, ING Groep NV, DekaBank, Banca Sella, KBC Group NV, and Danske Bank AS, is also underway to introduce a joint euro-backed stablecoin initiative that complies with MiCA regulations.

Recently, Citigroup announced its decision to join this consortium of banks to develop a euro-pegged stablecoin.

The growing demand for euro-backed tokens is fueled by the need to challenge the U.S. dollar’s dominance in the stablecoin market. According to data from DeFi Llama, Tether’s USDT is the leading stablecoin by market capitalization, holding 59.01% of the market.

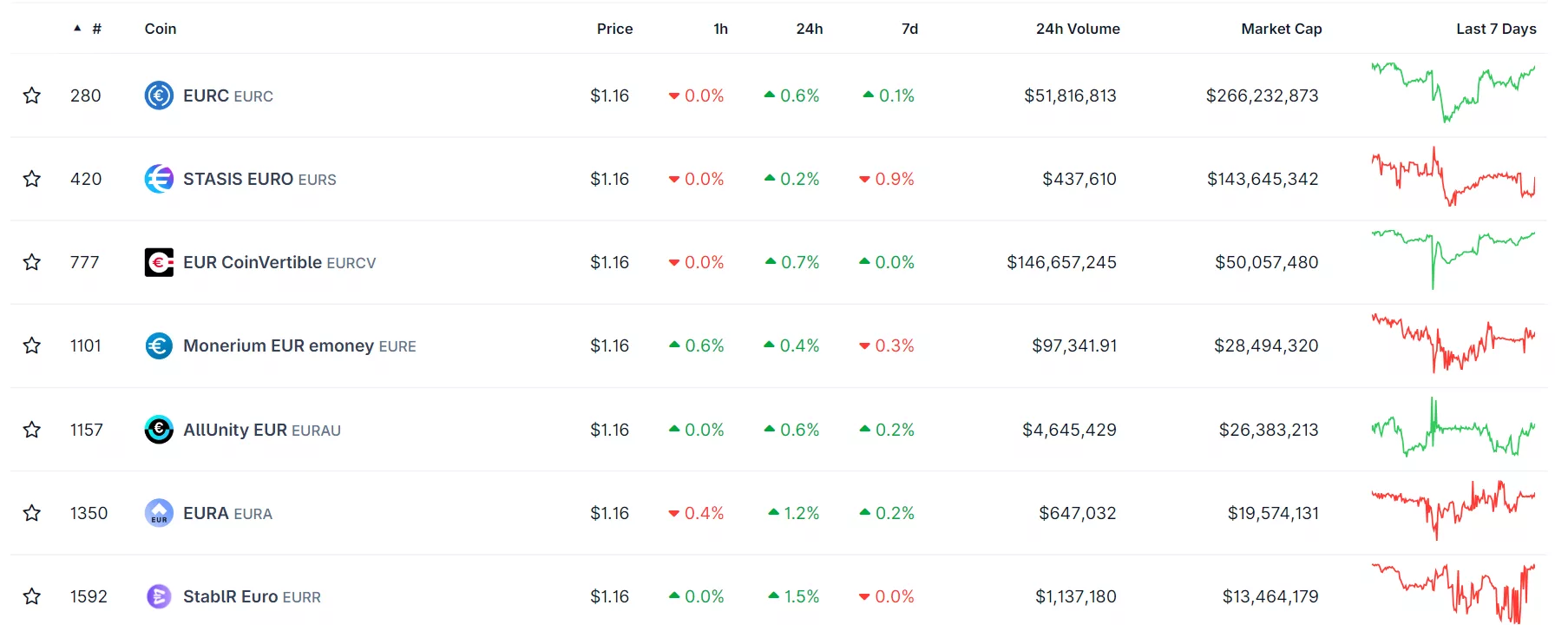

In comparison, euro-pegged stablecoins represent approximately $573.9 million of the total $306 billion stablecoin market cap. The largest euro stablecoin is Circle’s EURC, valued at $266 million, followed by EURS and CoinVertible’s EURCV.