Farewell to the Magnificent 7: Meet the New Leaders in AI Stocks

Wall Street’s renowned stock collective, the Magnificent Seven, might be facing obsolescence. Enter the Great Eight. Or maybe the Golden Dozen. Or even the TenAI of GenAI.

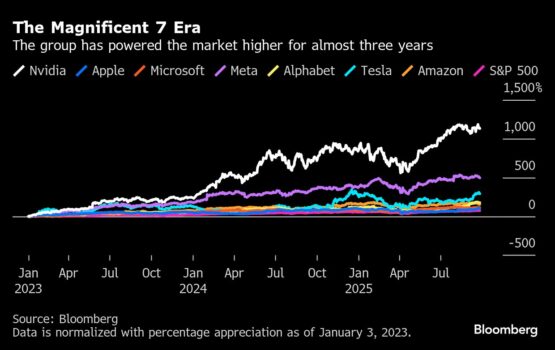

It has been almost three years since OpenAI’s ChatGPT catapulted artificial intelligence into the spotlight of the global economy. Throughout this period, one investment strategy has consistently dominated the US stock market: Buy the Mag Seven. This collection encompasses Nvidia Corp, Microsoft Corp, Apple, Alphabet, Amazon.com, Meta Platforms, and Tesla, all recognized as top choices for significant returns amid the most profound technological transformation since the internet.

While this narrative has largely unfolded, an unexpected transition has taken place on the journey towards global dominance. The AI trade has expanded, moving beyond several of the cherished big tech names. As a result, investment strategies focused on the Magnificent Seven—accountable for more than half of the S&P 500 Index’s 70%-plus increase since early 2023—are neglecting firms like Broadcom Inc., Oracle Corp., and Palantir Technologies Inc., which are also well-positioned for success in an AI-driven future.

“The Mag Seven may have prospered in earlier tech cycles, including mobile, the internet, and e-commerce, but that doesn’t ensure their success in this context,” remarked Chris Smith, the portfolio manager for Artisan Partners’ Antero Peak Group, overseeing $2.4 billion. “The next leaders will be those that capitalize on vast and unrestrained markets through AI, potentially outgrowing the Mag Seven as we know them.”

Nevertheless, the original seven aren’t disappearing anytime soon. The Mag Seven represents nearly 35% of the S&P 500, with earnings expected to increase over 15% in 2026, bolstered by 13% revenue growth, per Bloomberg Intelligence. In contrast, the rest of the S&P 500 (excluding the Mag Seven) is forecasted to experience only a 13% rise in earnings and a 5.5% growth in revenue next year.

However, disparities exist in the stock performance among this group. Nvidia, Alphabet, Meta, and Microsoft are viewed as well-positioned for an AI-centric era, with shares rising between 21% and 33% this year. On the other hand, Apple, Amazon, and Tesla show uncertain futures, lagging significantly behind.

ADVERTISEMENT

CONTINUE READING BELOW

“It’s challenging to regard the current Mag Seven as the ultimate representation of AI,” Smith noted.

The Bloomberg Magnificent 7 Total Return Index climbed 0.5% on Monday, with Nvidia leading the gains.

Consequently, Wall Street is proposing variations to the theme to uncover the true frontrunners. Some analysts have streamlined it to a “Fab Four” comprising Nvidia, Microsoft, Meta, and Amazon. Jonathan Golub, Seaport Research’s chief equity strategist, suggests excluding Tesla to form a “Big Six.” Others, like Ben Reitzes from Melius Research, promote an “Elite 8” that includes the Mag Seven along with Broadcom, which is now the seventh-largest company in the US by market capitalization.

However, none of these adaptations capture the entire AI landscape. For instance, Oracle’s shares have surged more than 70% this year, boosted by its AI-powered cloud initiative. Simultaneously, Palantir has emerged as the top performer in the tech-heavy Nasdaq 100 Index, skyrocketing 138% in 2025 due to robust demand for its AI software.

“A company may evolve into one that’s too significant to overlook,” stated Jurrien Timmer, managing director of global macro at Fidelity Investments, which oversees $16.4 trillion in assets. “As the AI narrative develops, new leaders may emerge to replace established ones, even if the latter continue to succeed.”

ADVERTISEMENT:

CONTINUE READING BELOW

The notion of the Magnificent Seven isn’t new to Wall Street, which frequently assembles collections of popular stocks to simplify market navigation for investors—from the Nifty Fifty of the 1960s to the Four Horsemen of the dot-com era and the FAANGs that ruled from the smartphone era to now. Yet, just as these groups excelled in their respective times, they eventually ceded power to new challengers, a transition likely in the AI space.

In a signal that Wall Street is shifting its attention away from the Mag Seven, Cboe Global Markets Inc. is introducing futures and options based on the newly established Cboe Magnificent 10 Index. This will feature the original seven alongside Broadcom, Palantir, and Advanced Micro Devices Inc., Nvidia’s smaller rival in processing chips.

This index highlights the subjective nature of such evaluations. Cboe announced this on Sept. 10—coincidentally coinciding with Oracle’s largest single-day gain since 1992, reinforcing its position as a key AI player. Despite Oracle outperforming most of the Mag Seven since early 2023, it was still omitted from the Magnificent 10.

“We need to widen the discussion beyond just the Mag Seven,” stated Nick Schommer, a portfolio manager managing approximately $34.7 billion across various investment strategies, including the Janus Henderson Transformational Growth ETF. “Oracle and Broadcom are certainly part of that conversation now.”

While Cboe did not provide a representative to elaborate on the criteria for the index, it mentioned in its press release regarding the Mag 10 that components were chosen “based on liquidity, market value, trading volume and leadership in areas such as artificial intelligence and digital transformation.”

Next Generation Leaders

Wall Street analysts have proposed different names as potential candidates for the next wave of leadership, with some companies consistently appearing in discussions. Taiwan Semiconductor Manufacturing Co. is considered a pivotal element of the AI ecosystem, alongside Oracle and Broadcom. Palantir is viewed as one of the few AI software victors at a time when traditional leaders like Salesforce Inc. and Adobe Inc. are perceived to be lagging.

As for stocks that are losing their luster, Apple and Tesla top the list. Apple is not maintaining the same growth rates as other tech giants and is seen as lagging in AI advancements. Meanwhile, Tesla’s electric vehicle market is under severe pressure due to rising competition and declining sales.

ADVERTISEMENT:

CONTINUE READING BELOW

Nonetheless, both still have loyal shareholders betting on their future potential. For Apple, the belief is that the iPhone will remain a primary device for millions accessing AI technologies. Tesla investors are counting on CEO Elon Musk’s ventures in autonomous vehicles and humanoid robots, both reliant on AI integration for future achievements.

A growing number of sectors are benefiting from advancements in AI, including power generation and various aspects of AI infrastructure development. This encompasses companies such as Arista Networks Inc. (communications), Micron Technology Inc. (memory chips), and storage firms like Western Digital Corp., Seagate Technology Holdings Plc, and SanDisk Corp.

Another wrinkle in pinpointing the AI narrative is that many essential companies are privately held. OpenAI would undoubtedly feature on any list of AI success stories, but remains inaccessible to many investors, despite reportedly seeking to sell shares at a valuation nearing $500 billion. Others, like Anthropic and SpaceX, also remain outside the public market.

As AI continues to progress, the beneficiaries will likely shift from those fostering its growth to companies delivering AI-specific products and services, and ultimately to those utilizing AI for efficiency and expansion. This transition will likely shape the ultimate victors of AI—regardless of what labels Wall Street assigns them.

“As this evolution unfolds, the leaders of the AI boom could become overpriced, and their growth and cash flow might not seem as advantageous,” warned Fidelity’s Timmer. “The challenge with a concentrated market is the risk of a disruptive change if the leadership falls out of favor. While the current valuations don’t raise any alarms for me, we can’t definitively say whether the Mag Seven era will conclude smoothly or with turbulence.”

© 2025 Bloomberg

Follow Moneyweb’s comprehensive finance and business news on WhatsApp here.