4 Factors Driving the Crypto Market Past $4 Trillion

This week, the cryptocurrency market is witnessing a significant upswing, with Bitcoin and Ethereum nearing their all-time highs, while the total market capitalization has exceeded $4.2 trillion. This article discusses the four main factors driving this rally, including growing expectations that the Federal Reserve may lower interest rates before the year’s end.

Summary

- The cryptocurrency surge aligns with increasing expectations of Fed rate cuts.

- Bitcoin is perceived as a safe haven amidst the looming U.S. government shutdown.

- The crypto market has historically shown strong performance in October and the fourth quarter.

Heightened Expectations for Fed Rate Cuts

A major factor driving the crypto market’s rise is the increasing probability that the Federal Reserve will lower interest rates in its remaining two meetings of the year.

Following the release of a weaker-than-anticipated jobs report from ADP on Wednesday, the chances of rate cuts surged. The U.S. economy reported a loss of 36,000 jobs in September, contrary to economists’ forecasts of a gain exceeding 50,000 jobs.

This data implies that the Fed might consider cutting rates again to stimulate the economy. Historically, cryptocurrencies and other high-risk assets thrive under such conditions.

Bitcoin as a Safe Haven Asset

The cryptocurrency market has rallied as investors turn to Bitcoin (BTC) as a safe-haven asset during the ongoing U.S. government shutdown. This behavior mirrors gold’s recent surge to record high prices this year.

A recent white paper from BlackRock emphasized that investors recognize strong fundamentals in Bitcoin that bolster its reputation as a safe-haven asset in times of increased risk. The paper noted factors such as its limited supply of 21 million and rising demand.

Evidence of cryptocurrencies acting as safe havens is reflected in consistent ETF inflows. Ethereum (ETH) funds experienced over $1.3 billion in inflows, while Bitcoin ETFs accumulated a total of $3.2 billion in assets.

Bitcoin and Altcoins Gain from Seasonal Trends

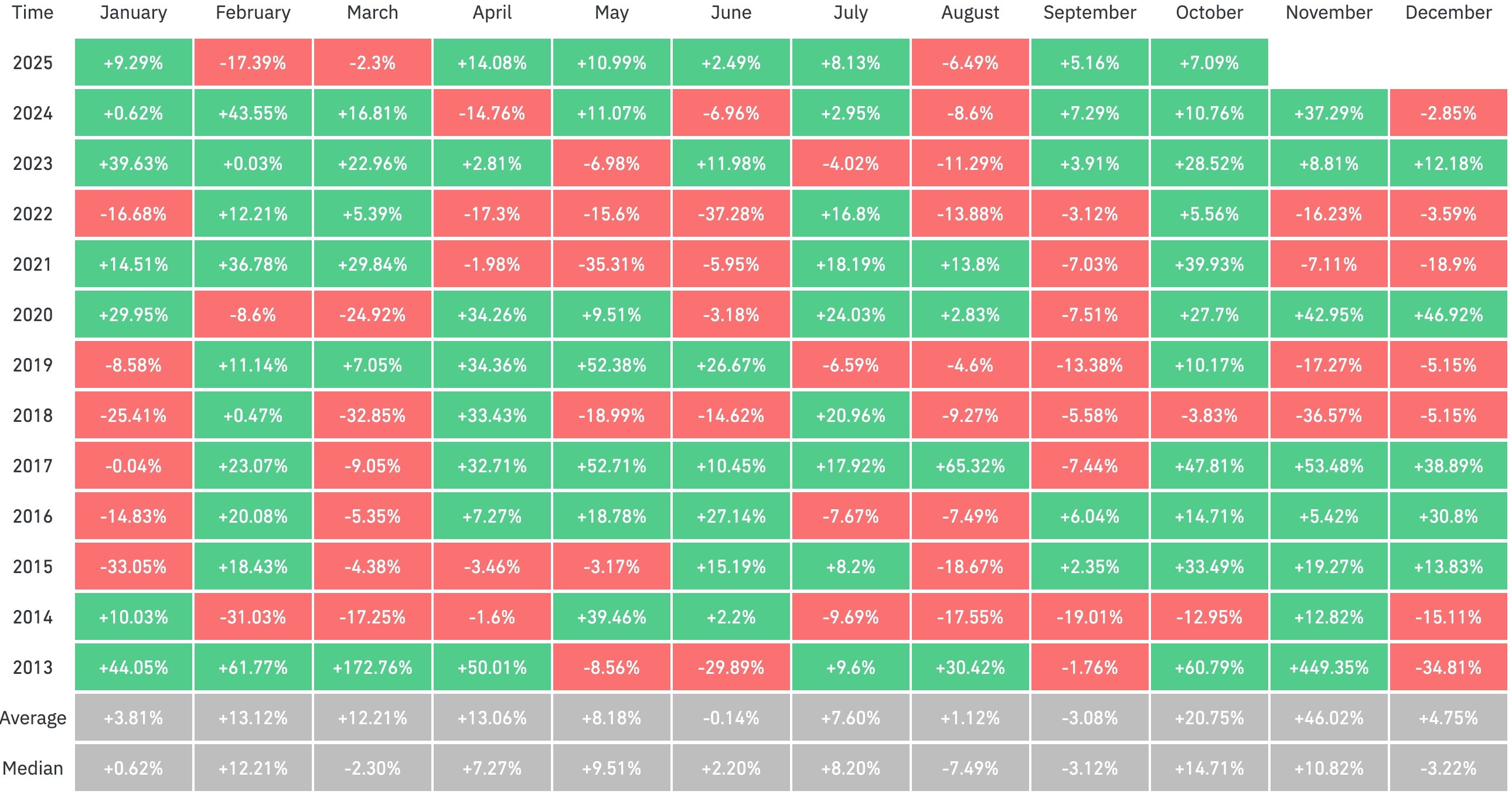

Seasonality has also contributed to this week’s rally in the crypto market. Investors are pointing to “Uptober,” a term used to describe the market’s tendency to rally in October.

Data from CoinGlass shows that Bitcoin’s price usually increases in October, with positive returns recorded in every October since 2020. The average October return since 2013 stands at 20%, making it the second-best month after November.

Moreover, the fourth quarter is typically the most advantageous time for the cryptocurrency market throughout the year, with Bitcoin averaging an 80% return, following a 51% return in the first quarter.

Anticipation of Altcoin ETF Approvals

Another significant factor contributing to the rising crypto market is the optimism regarding the potential approval of altcoin ETFs by the Securities and Exchange Commission.

The SEC has set October as the deadline for most altcoin ETF applications, including notable names like Solana and XRP. These approvals are expected to drive up prices, likely attracting Wall Street investors, similar to past trends with Ethereum and Bitcoin.