US Stocks Anticipated to Navigate Risks for Year-End Gains, Survey Finds

A recent Markets Pulse survey indicates that stocks are likely to bypass concerns over inflation and a weakening jobs market to conclude the year on a positive note.

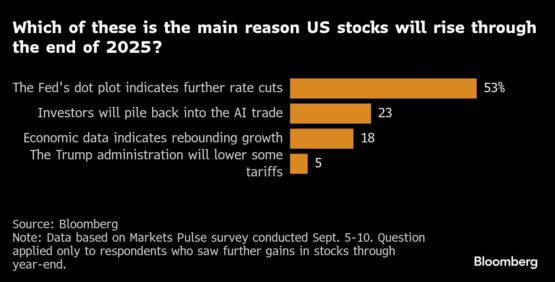

About two-thirds of the 116 respondents in a poll conducted from September 5-10 are optimistic that the S&P 500 will continue its ascent in 2025. The majority anticipate that this upward momentum will be driven by indications from the Federal Reserve regarding further interest-rate cuts before year-end.

This week, an unexpected and notable preliminary drop in payroll numbers took traders off guard, leading to speculation that average monthly job growth might be only about half of what had been reported officially through March this year.

Listen: US jobs data nearly guarantees a US rate cut.

This information has introduced a layer of caution about the US economy, boosting expectations for nearly three rate cuts this year, with the first policy decision anticipated on September 17. It has also reignited conversation around a potential more considerable reduction of 50 basis points from the Fed in the coming week.

ADVERTISEMENT

CONTINUE READING BELOW

Matt Maley, chief market strategist at Miller Tabak & Co, commented, “The argument holds as long as the rate cuts are minor and gradual. Wall Street would welcome that. However, if the cuts are aggressive, it will suggest a significant slowdown in growth, which may not be favorable for the current pricey stock market.”

Economic Concerns

Strategists at JPMorgan Chase & Co warn that the Fed’s decision next week might dampen investor optimism, especially if policymakers go ahead with an anticipated interest-rate cut. This could recall last year’s situation when rates were slashed by 50 basis points, yet the S&P 500 faced a 0.3% decline that day amid economic worries.

Nonetheless, traders are supported by historical patterns. Generally, when the Fed decreases rates, stock prices tend to increase in the following weeks and months, regardless of the initial market reaction, according to a Markets Live analysis.

Yet, economic uncertainties loom large in the backdrop of the survey results. Less than 20% of respondents cited rebound economic data as a reason for stock price increases.

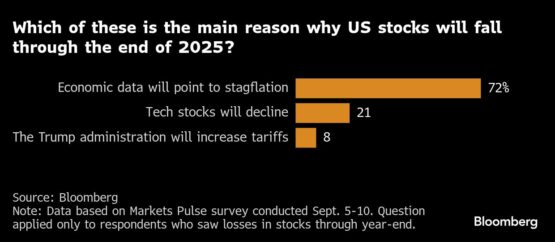

Among those predicting a downturn in the stock market for the rest of the year, stagflation concerns in the US overshadowed other issues, such as plummeting tech stocks or rising tariffs under President Donald Trump.

Michael Bailey, director of research at FBB Capital Partners, stated, “The economy teeters on the edge of mild stagflation. I anticipate inflation to remain slightly elevated in the low single digits, while unemployment will gradually rise. However, true stagflation dangerously approaches a severe recession that’s hard to reverse.”

ADVERTISEMENT:

CONTINUE READING BELOW

A Mixed Outlook

Current data suggests an economy that is neither extremely weak nor robust. While job growth has plateaued and the housing market faces difficulties, recent economic surveys show improvements in both the manufacturing and services sectors.

Consumers seem to be faring well, particularly as the expectation of rate cuts raises the likelihood of a soft landing — a favorable outcome for stocks.

“The stock market’s ability to absorb weakness in the labor market hinges on whether the monetary policy response is strong enough to alleviate growth risks,” analysts from Morgan Stanley, including Mike Wilson, highlighted in a recent report. “With the Fed remaining focused on inflation potentials and the labor data being lackluster but not critically so, uncertainties persist regarding the extent of Fed cuts.”

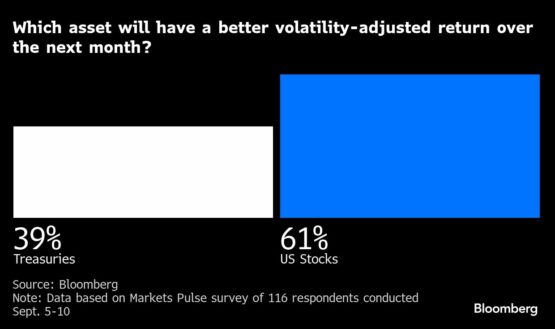

Equities are expected to deliver better volatility-adjusted returns than bonds in the coming month, although survey respondents are divided on whether 10-year yields will rise or fall soon. Nevertheless, most expressed the belief that the yield curve will steepen this year as long-dated Treasuries continue to be influenced by inflation concerns, fiscal issues, and threats to Fed independence.

© 2025 Bloomberg

Follow Moneyweb’s comprehensive finance and business news on WhatsApp here.