Gold Hits All-Time Inflation-Adjusted High, Surpassing 1980 Benchmark

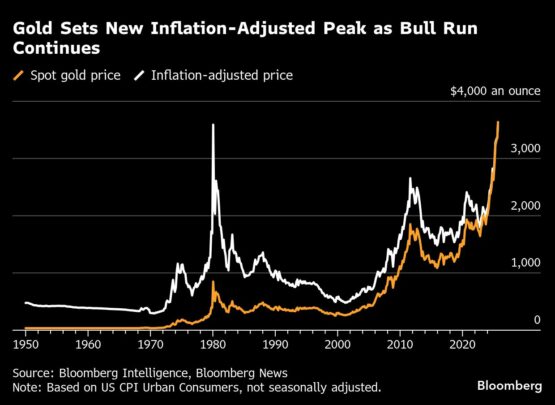

Gold has exceeded its inflation-adjusted record set over 45 years ago, as increasing concerns about the US economy drive bullion’s impressive three-year bull market into new and uncharted territories.

This month, the spot price of gold has increased by about 5%, hitting an all-time high of $3,674.27 per ounce on Tuesday. In 2025 alone, it has established more than 30 nominal records, with the recent rally surpassing the inflation-adjusted record achieved on January 21, 1980, when prices reached $850.

When adjusted for decades of consumer price inflation, this corresponds to roughly $3,590—though various methods provide differing figures, and some adjustments indicate that the 1980 peak was lower. Nonetheless, analysts and investors agree that gold has solidly surpassed this threshold, reaffirming its status as a traditional hedge against rising prices and declining currencies.

“Gold is a uniquely significant asset that has proven its worth over centuries—if not millennia—of being a dependable hedge,” stated Robert Mullin, portfolio manager at Marathon Resource Advisors. “Asset allocators are currently entering a phase of legitimate concern over both the scale of deficit spending and their skepticism regarding central banks’ genuine commitment to addressing inflation.”

The precious metal has nearly soared 40% this year, propelled by President Donald Trump’s tax cuts, an increasingly aggressive global trade approach, and his unique influence over the Federal Reserve. A selloff in the dollar and long-term US government bonds earlier this year triggered alarm over the declining interest in American assets, raising doubts about the safety of the nation’s debt in uncertain times.

When gold hit $850 in January 1980, the US was grappling with a weakening currency, soaring inflation, and an impending recession. In the two months prior, the price had doubled after President Jimmy Carter’s freeze on Iranian assets due to a hostage crisis in Tehran, which heightened risks for foreign central banks holding dollar-denominated assets.

“Gold reflects a renewed recognition that inflation is a persistent issue, coupled with global uncertainty,” noted Carmen Reinhart, former senior vice president and chief economist at the World Bank Group. She observed that gold’s historical role as an inflation hedge contributed to its prominence in the 70s and 80s, but its importance stretches back even further—gold has consistently been crucial during uncertain times.

ADVERTISEMENT

CONTINUE READING BELOW

In contrast to the sharp climb to the 1980 peak—which was followed by a quick decline—today’s rise has occurred with far less volatility. This is largely due to a more liquid and accessible market and the increased participation of a diverse group of investors, which helps counterbalance traditional demand weaknesses.

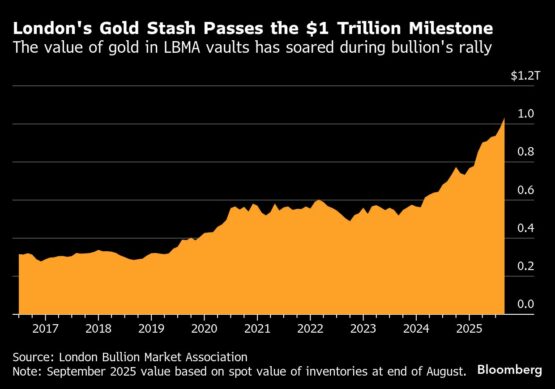

Due to the price surge, the value of gold stored in London vaults surpassed $1 trillion last month, making it the second-largest asset in global central bank reserves, overtaking the euro.

Grant Sporre, global head of metals and mining at Bloomberg Intelligence, has updated his analytical models to account for the wide range of factors driving gold’s impressive rally. His findings indicate that gold is overpriced relative to historical standards, except in one critical context: Compared to US stocks, gold appears relatively inexpensive, and he expects prices could rise further if equity markets start to falter.

“Gold is overpriced, yet the market is willing to pay this premium for the security it provides,” remarked Sporre.

Gold’s Resurgence

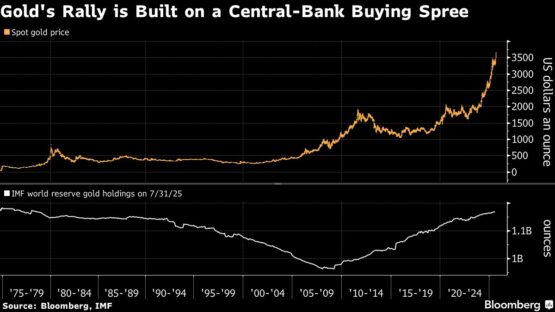

This signifies a remarkable comeback for an asset that faced scrutiny from central bankers during the 1990s and 2000s, when the end of the Cold War, the establishment of the eurozone, and China’s admission to the World Trade Organization heralded a new era of globalization dominated by the dollar. As stock markets surged, many individual investors distanced themselves from gold as well.

However, many central banks are now re-entering the gold market to diversify their foreign currency reserves and protect themselves from sanctions targeting US adversaries. Prices have almost doubled since Russia’s invasion of Ukraine and the subsequent freezing of the Kremlin’s overseas assets, attracting broader institutional investments following Trump’s inauguration.

ADVERTISEMENT:

CONTINUE READING BELOW

Intermittent buying sprees in China and a renewed enthusiasm for exchange-traded funds have made gold more accessible for retail investors, providing additional support during this period.

“The transition from a unipolar to a multipolar world seems to have accelerated gold’s allure as a key asset for central banks,” observed Greg Sharenow, a portfolio manager at Pacific Investment Management Co. “Wealthy individuals are recognizing similar trends, positioning gold as a significant beneficiary of asset diversification.”

In the last two weeks, prices have surged once again, breaking through all-time nominal highs set in April following a period of stable trading. This latest increase has been fueled by investors across financial sectors speculating that the Fed may soon cut interest rates to address slowing job growth and a potential economic downturn.

Historically, lower interest rates have made gold more appealing compared to interest-earning assets like Treasuries, while also placing pressure on the dollar. Additionally, with Trump’s unprecedented challenge to the Fed’s independence, gold advocates are increasingly watchful of the possibility that the central bank may be compelled to aggressively lower rates, notwithstanding rising inflationary pressures.

When a similar situation unfolded in the early 1970s—with a declining dollar as then-President Richard Nixon pressured the Fed to maintain low rates in response to inflation fears—it triggered a massive gold rally, with the oil shocks of that time ultimately propelling prices to their peak of $850.

“I observed the existing circumstances: Countries were accumulating massive debts, printing excessive amounts of money, and devaluing their currencies,” recounted Jim Rogers, co-founder of the Quantum Fund with George Soros, who began investing in gold in the early 1970s. “I also recognized that gold and silver were reliable means of protection in such times.”

© 2025 Bloomberg

Stay informed with Moneyweb’s comprehensive finance and business news on WhatsApp here.