China Floods Global Market with Budget-Friendly Exports in Response to Trump’s Tariffs

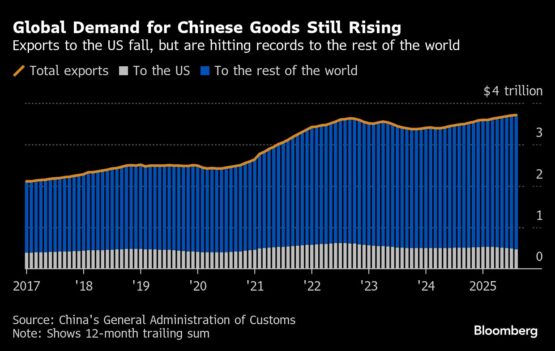

President Xi Jinping’s export mechanisms have remained steadfast despite over five months of heightened US tariffs, guiding China towards an extraordinary $1.2 trillion trade surplus.

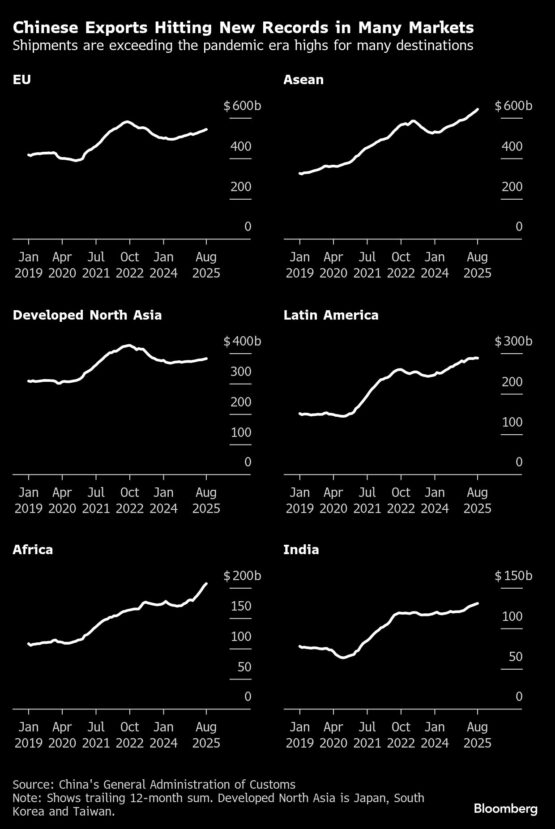

In the face of dwindling access to US markets, Chinese manufacturers have displayed remarkable adaptability: imports from India hit a record high in August, exports to Africa are on track for an unprecedented annual figure, and shipments to Southeast Asia have exceeded pre-pandemic numbers.

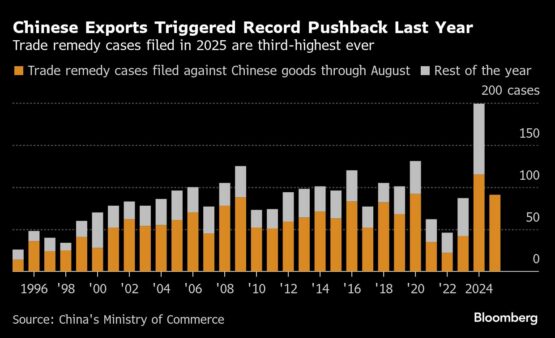

This expansive growth is raising alarms worldwide as countries weigh the possible detriment to their local industries against the potential backlash of aggravating Beijing, the central trading partner for more than half the globe.

So far this year, only Mexico has openly reacted by proposing tariffs as high as 50% on specific Chinese products like vehicles and steel, while other nations are increasingly feeling compelled to respond. Indian officials have reportedly received 50 applications recently to investigate alleged dumping of goods from China and Vietnam, according to an anonymous insider. In Indonesia, the trade minister has committed to monitoring a surge of products following viral videos showcasing Chinese vendors selling jeans and shirts for as little as 80 US cents in major cities.

Yet, countries appear cautious regarding more aggressive measures. Those already in tariff discussions with the Trump administration appear reluctant to initiate another trade conflict with the world’s second-largest economy, giving Beijing some buffer from US tariffs, which economists initially predicted would significantly impact China’s growth rate.

“The subdued response may be shaped by ongoing US trade dialogues,” remarked Christopher Beddor, deputy director of China research at Gavekal Dragonomics. “Certain nations might be wary of contributing to a collapse of the global trading order, while others may postpone imposing tariffs on China to use them later as leverage in negotiations with the US.”

Officials attempting to shield their economies from Beijing are proceeding with caution. South Africa’s trade minister has cautioned against imposing punitive tariffs on Chinese vehicle exports, which have nearly doubled this year, choosing instead to focus on attracting further investment. Meanwhile, Chile and Ecuador have discreetly introduced targeted fees on low-cost imports after witnessing a 143% increase in monthly active users for Chinese e-commerce platform Temu in Latin America since January. Brazil has threatened stricter retaliation but has also allowed Chinese electric vehicle manufacturer BYD Co. a tariff-exempt period to bolster local production this summer.

A BYD factory under construction in Camacari, Brazil, January. Image: Tuane Fernandes/Bloomberg

ADVERTISEMENT

CONTINUE READING BELOW

Beijing is leveraging both diplomatic skills and economic influence to dissuade nations from taking retaliatory actions. Earlier this month, President Xi urged Brics nations during a leadership call to present a united stance against protectionism while officials from the Commerce Ministry warned Mexico to reconsider its approach, suggesting that such moves could have repercussions. Adding to the complexities, Trump has urged NATO allies to impose tariffs as high as 100% on Chinese goods due to its support for Russia.

Chinese authorities maintain that their trade practices fall within acceptable limits and assert that Beijing does not aim to monopolize global markets. “China will export in line with international demand,” stated Vice Finance Minister Liao Min in July. The state-controlled People’s Daily defended Chinese exporters against Western accusations of “dumping,” asserting that they do not sell below production costs.

If Trump successfully rallies other nations against China, it could complicate the nation’s internal struggles, including a lingering property market slump and an aging population, according to Bloomberg Economics’ Chang Shu and David Qu. “Beijing would likely respond with reciprocal tariffs, which could alienate allies when they are most needed,” they pointed out. “Over time, this might also incentivize companies to shift production closer to partner countries.”

Even as Chinese exporters exceed expectations, this trade surge has not translated into increased wealth or resolved domestic issues. Profits at industrial companies fell by 1.7% in the first seven months as manufacturers prioritized reducing overproduction under Xi’s “anti-involution” strategy, which led to price reductions aimed at boosting foreign sales. This situation aggravates China’s ongoing deflation, which is on track for its longest duration since the late 1970s, when the country began opening its markets.

The export boom could also impede Beijing’s efforts to transition its economy toward enhanced domestic consumption, contradicting foreign officials like US Treasury Secretary Scott Bessent, who have advised that boosting Chinese consumer activity should be at the heart of its five-year plan. The upcoming policy document outlining these goals will be critical during an important Communist Party meeting in the coming weeks.

For Xi, the potential dangers may be justified. Showing that China is not dependent on the US consumer could bolster his position ahead of a crucial summit meeting with Trump in South Korea. The two largest economies continue to negotiate a potential trade agreement, maintaining a truce on tariffs as high as 145% in the interim.

China Shock 2.0

Before Trump enacted the highest tariffs in the US since World War II in April, emerging markets were concerned about the loss of millions of manufacturing jobs due to a deluge of Chinese goods. The former president of Indonesia even proposed a 200% tariff to protect local industries, while Brazil increased tariffs on Chinese steel. Vietnam also quickly responded against Chinese e-commerce entities that undercut local prices.

ADVERTISEMENT:

CONTINUE READING BELOW

Ultimately, foreign leaders have found it difficult to shield their economies from China’s vast manufacturing capabilities.

“Protectionist measures from the US and other nations have become ineffective as Chinese exporters remain highly competitive,” stated Arthur Kroeber, head of research at Gavekal Dragonomics. They “can absorb some tariff strains and utilize various strategies such as transshipment and relocating late-stage production to countries with lower tariffs.”

While increased shipments to Vietnam suggest that some products previously aimed at the US and other destinations are being rerouted to avoid Trump’s tariffs, this trend is part of a broader scope. The growing demand for China’s advanced technological innovations has significantly fueled recent trade activity. Moreover, increased sales to affluent markets in Europe and Australia show that Beijing has successfully tapped into new consumer bases for many of its goods.

India exemplifies how Trump’s restructuring of the global trade landscape unexpectedly favors Beijing. Exports to this neighboring nation reached a record $12.5 billion last month, largely due to Apple Inc.’s suppliers quickly shifting iPhone production to India from its Asian counterparts. Nevertheless, these firms still depend on parts and tools predominantly sourced from China.

In July, Chinese businesses exported nearly $1 billion worth of semiconductors to India, along with several billion more in mobile devices and components, according to data from Beijing. This trend is on track to surpass last year’s record, with the current export value in 2025 nearing that of the entirety of 2021.

“China has exceeded expectations in the first half,” noted Sajjid Chinoy, chief India economist at JPMorgan Chase & Co., during an interview with Bloomberg Television. “Some of this is due to China’s expertise in securing alternative export markets, such as Europe, which has provided a vital buffer against dwindling exports to the US.”

ADVERTISEMENT:

CONTINUE READING BELOW

Yangshan Deepwater Port in Shanghai, May. Image: Qilai Shen/Bloomberg

A depreciating currency has also positioned China favorably. The yuan has declined alongside the dollar against currencies such as the euro. Macquarie Bank recently indicated that the yuan’s real effective exchange rate, which accounts for inflation disparities between countries and their major trading partners, is at its lowest since December 2011.

The Federal Reserve’s recent interest rate cut could further lower the dollar and potentially the yuan, boosting global demand and enhancing the attractiveness of Chinese exports.

Read: Surfing the Trump tsunami

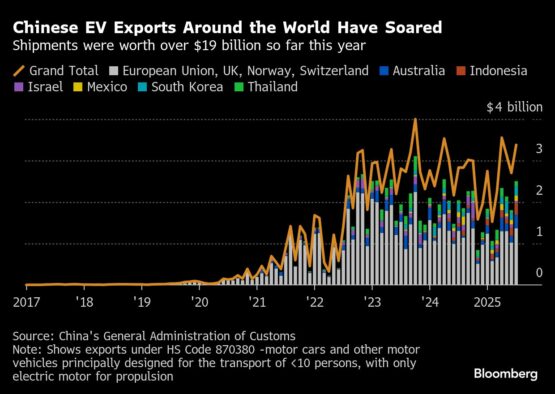

Despite widespread concerns, halting the inflow of goods from China is unlikely to be a straightforward endeavor. Chinese electric vehicle exports have flourished despite the US and Canada’s attempts to restrict them through tariffs and prohibitions.

In the initial seven months of this year, companies like Nio, BYD, and Xpeng exported over $19 billion worth of electric vehicles, nearly matching figures from the preceding year, with Europe emerging as the largest market even post the EU’s tariff implementation last October.

China finds itself in a relatively strong position compared to many other countries, as it explores alternative markets beyond the US, according to Adam Wolfe from Absolute Strategy Research. Their analysis reveals an almost 50% overlap between China’s exports to the US and its shipments to Brics nations, indicating that a portion of goods previously bound for America can be redirected to other markets.

“China has shown its capacity to enter new markets and expand its share abroad, a trend expected to continue,” stated Wolfe. “I do not anticipate a decline in China’s exports for the remainder of the year.”

© 2025 Bloomberg

Follow Moneyweb’s comprehensive finance and business news on WhatsApp here.