Billionaires Amassing Gold Wealth in Dubai Face Slowdown

In Dubai, new wealth is being generated every day as fresh talent and investment flow into the region. Yet, a significant portion of the increase in personal fortunes is linked to the city’s established visitors.

A distinguished group of Indian entrepreneurs, leveraging the subcontinent’s cultural and historical ties to the Gulf, is transforming the retail gold sector within the rapidly growing United Arab Emirates. They are converting what was once a fragmented industry into expansive empires filled with luxurious showrooms and fully integrated supply chains.

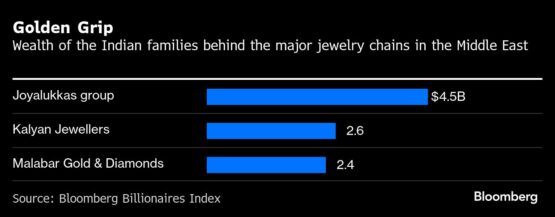

From the Gold Souk to high-end shopping malls, brands such as Malabar Gold & Diamonds, Joyalukkas India, and Kalyan Jewellers India — all owned by some of India’s richest individuals — dominate the region’s jewelry market aimed at the middle class. Their founders have collectively amassed a wealth of $9.5 billion, according to the Bloomberg Billionaires Index, marking their first recognition in this regard.

Dubai has long been a hotspot for gold purchases, and these tycoons are capitalizing on a growing South Asian expatriate demographic, increasing tourist visits, and a cultural affinity for gold, establishing extensive retail networks with multiple outlets.

In 2023, the UAE welcomed 7.2 million Indian nationals, more than any other country in the Middle East, as per government statistics. Additionally, over 3.5 million Indians reside in the UAE, according to the Ministry of External Affairs. The two nations have maintained robust connections for decades.

However, recent regulatory shifts in India pose a threat to burgeoning sales. Last year, the country lowered import duties on gold, which lessened the price advantage of buying it abroad and decreased demand from Indian purchasers in the UAE.

Jewelry demand within the UAE dropped by 16% in tonnage during the second quarter compared to the same period last year, impacted by soaring gold prices and diminished tourist spending—especially from Indian visitors. This decline coincides with the import duty modifications in India, states the World Gold Council.

ADVERTISEMENT

CONTINUE READING BELOW

“Most of our customers are Indian, followed by other South Asians and a few local Arabs,” noted Ramesh Kalyanaraman, executive director at Kalyan Jewellers, run by his billionaire family.

India has historically displayed a volatile fiscal landscape regarding gold. Anindya Banerjee, head of commodities and currency research at Kotak Securities, suggests this trend may persist.

Last year, the UAE recorded the highest gold demand per capita globally at 4.4 grams, according to the World Gold Council. Many Indian tourists and expatriates view the precious metal as a stable investment, while others regard bars and coins as effective savings instruments. Additionally, gold is frequently purchased for weddings and religious celebrations.

“Jewelry shopping has transitioned from an annual occurrence to happening three or four times a year, as people buy items for specific occasions,” explained Kalyanaraman.

Kalyan entered the Gulf market in 2013 and now operates 36 stores in the region. The company reported $369 million in revenue from the Middle East for the year ending March 31, marking a 22% increase from the previous year, according to company data. Kalyanaraman indicated that the firm may consider expanding its manufacturing capabilities in Dubai to adapt to U.S. tariffs.

Joyalukkas started as a small jewelry shop in Kerala, India, before growing into a leading retail brand. It opened its first showroom in the UAE in 1988, later branching into Qatar and Oman. Currently, it has 50 locations in the Middle East, with 28 in the UAE.

ADVERTISEMENT:

CONTINUE READING BELOW

“When I arrived in Dubai in 1986, I saw opportunities where others found barriers,” recalled Joy Alukkas, the company’s chairman.

Malabar has 67 outlets in the UAE, along with 17 stores in Saudi Arabia and 39 in Oman, Qatar, Bahrain, and Kuwait. Founded by Indian entrepreneur M.P. Ahammed, who began in spice trading, the company opened its first store in the Middle East in 2008.

Some developments are already emerging in the sector. This summer, Tata Group’s watch and jewelry division, Titan Co., agreed to acquire a controlling stake in Damas International’s jewelry business in the Gulf region. Titan operates the Tanishq chain, which has branches across the UAE, Qatar, and Oman.

While the recent import duty changes have narrowed the price gap between India and the UAE, they have not significantly affected Malabar’s business, according to a company spokesperson. Many Indians still view the UAE as a destination for consistently high-quality gold, which distinguishes it from other locations, they insisted. The three companies also maintain a strong presence in India, providing a hedge against downturns elsewhere.

Moreover, some industry insiders believe there is substantial potential for growth. Malabar recently introduced Mojawhraty, a retail initiative aimed at meeting the preferences of Arab customers.

“Jewellers should continuously innovate in design to attract the diverse demographics of various nationalities residing in or visiting the UAE and the broader region,” advised Andrew Naylor, head of Middle East and Public Policy at the World Gold Council.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.