Five Crucial Graphics to Keep an Eye on in the Worldwide Commodity Markets This Week

Oil traders are exercising caution as they seek insights at a significant energy conference in London this week. Meanwhile, gold is flowing into the US as the market offers lucrative arbitrage chances. Additionally, liquefied natural gas prices in Europe are beginning to stabilize as supply concerns diminish.

Here are five key charts worth examining in the global commodity markets as the week gets underway.

ADVERTISEMENT

CONTINUE READING BELOW

Oil

Oil traders will convene in London for International Energy Week amid a surprisingly calm market environment. US President Donald Trump’s recent policy shifts and trade actions, coupled with ongoing uncertainties in Ukraine and the Middle East, have kept crude futures confined to a tight range this month, while volatility has dipped to its lowest since July. Industry leaders are expected to deliberate on a forthcoming OPEC+ decision regarding potential production increases and other factors that could invigorate the market.

Energy industry

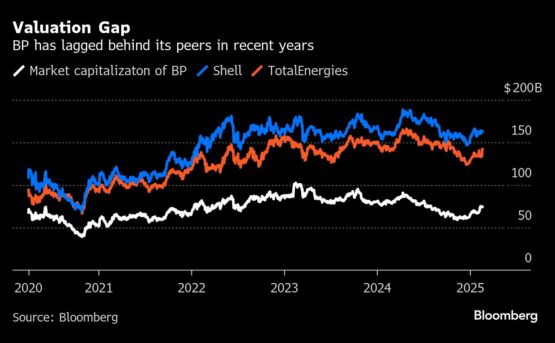

BP Plc finds itself under the scrutiny of the renowned activist investor, Elliott Investment Management, which has acquired a significant stake in the struggling oil company. Elliott is calling for drastic changes, such as substantial cost reductions, asset sales, and a withdrawal from renewable energy. After a lengthy wait, investors anticipate hearing from Chief Executive Officer Murray Auchincloss on Wednesday, who is expected to unveil a new strategy aimed at fundamentally transforming the company.

Corn

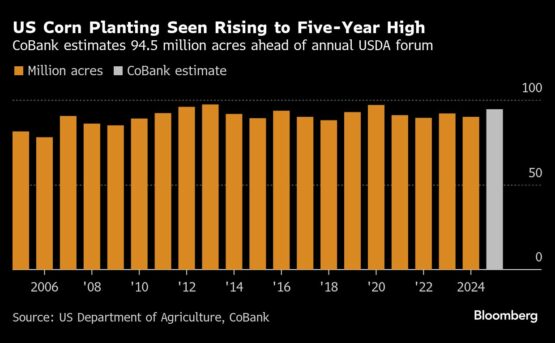

The US Department of Agriculture’s annual outlook forum is set to provide the first closely watched acreage estimates for key American crops including corn, soybeans, wheat, and cotton. Farm lender CoBank predicts that corn acreage will increase to its highest level in five years, positioning corn as the leading crop in the US, which remains the world’s largest producer and exporter of the grain.

Gold

In recent months, US gold prices have surged beyond international benchmarks due to concerns that gold might fall under Trump’s larger tariff measures. Although many market participants do not anticipate tariffs on the precious metal considering its monetary significance, the substantial price gap is resulting in increased activity among dealers, traders, and investors who are rushing to send gold to the US to take advantage of the premium. Consequently, there has been a significant increase in bullion inventory at Comex warehouses, with holdings rising by more than 20 million ounces since the US election.

ADVERTISEMENT:

CONTINUE READING BELOW

LNG

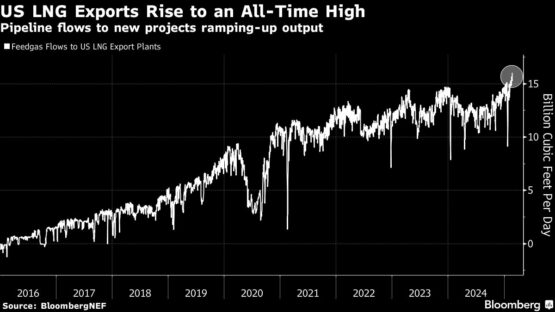

High natural gas prices in Europe and Asia are projected to ease thanks to the US, the leading liquefied natural gas supplier in the region, providing much-needed relief. US exports to LNG terminals have reached record levels, nearly 20% higher than a year ago. This surge, along with milder weather patterns, possible resolutions to the conflict in Ukraine, and discussions within the European Union regarding more flexible storage guidelines, are helping to alleviate supply concerns.

© 2025 Bloomberg

Stay updated with Moneyweb’s comprehensive finance and business news on WhatsApp here.