Bybit ETH Reserves Surge as Ethereum Experiences Fluctuations Post-Lazarus Hack

The price of Ethereum has remained stable as the market adjusts to the $1.4 billion hack attributed to the Lazarus Group.

On Sunday, Ethereum (ETH) was trading at $2,795, slightly above last Friday’s low of $2,665. It is still approximately 32% lower than its peak in December of the previous year.

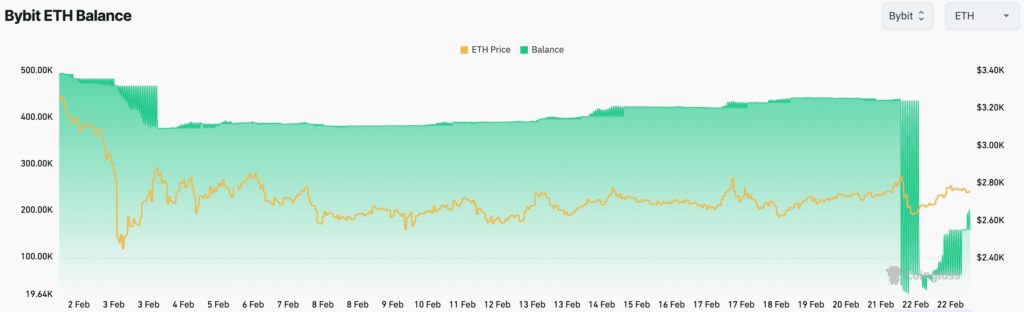

Data from Coinglass indicates that Ethereum balances on Bybit have begun to increase after experiencing a drop on Friday due to the hack. Balances have risen to over 200,000, amounting to $558 million, up from last Friday’s low of 61,000.

There are two likely explanations for the increase in Ethereum balances on Bybit. Firstly, Bybit may be actively purchasing ETH from the market to enhance user confidence.

Secondly, the increase could indicate that customers are transferring ETH to the exchange, reflecting a resurgence in confidence. Bybit has asserted that it will reimburse 100% of the stolen Ethereum tokens. Additionally, they have initiated a $140 million effort to trace the stolen funds, which may result in the recovery of some of the assets.

This situation follows a significant security breach where North Korea’s Lazarus Group reportedly accessed Bybit’s cold wallets and perpetrated the theft of ETH tokens valued at $1.4 billion. The scale of this hack has raised serious concerns about the security of cryptocurrency assets stored in cold wallets managed by exchanges.

Ethereum price could face a larger decline

The daily chart suggests that Ethereum may be at risk of a more significant drop in the short term. A death cross pattern has already formed, as the 200-day and 50-day weighted moving averages have intersected. This is regarded as one of the most bearish patterns in technical analysis.

Additionally, Ethereum has created a bearish flag pattern, which is a well-known continuation signal. This pattern is characterized by a vertical line followed by consolidation that resembles a rising wedge.

Consequently, it is likely that the ETH token will experience a bearish breakdown, with the next significant support level at $2,155, representing approximately a 23% decline from the current price.

A bullish outlook would be negated if the coin surpasses the 200-day WMA resistance at $3,085.